[ad_1]

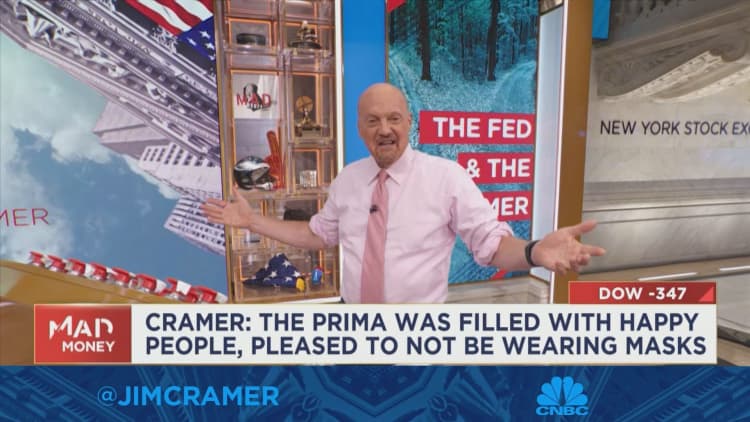

CNBC’s Jim Cramer on Thursday said that a huge driver of inflation is the consumer’s desire to spend money in the reopening economy – a fact that isn’t reflected in the data that the Federal Reserve and Wall Street are poring over.

“They don’t care about higher rates. They have savings because they did nothing for two years,” he said. “My biggest worry right now is that the aggregate data can’t capture the nature of this … one-time-only euphoria.”

Stocks slumped on Thursday after a strong start to the week that fizzled out by Wednesday. Investors are eyeing the nonfarm payrolls report release on Friday to gauge the size of the Federal Reserve’s next interest rate hike.

If job and wage growth is stronger than expected, the Fed is likely to stay the course on its aggressive campaign.

While a surge in travel this summer showed that Americans were eager to engage in revenge travel after Covid restrictions loosened, some are also now experiencing “recession fatigue” – waning motivation to continue making smart financial choices to prepare for tough economic times ahead.

Cramer noted that he expects consumers’ need to spend to wind down eventually, though it might not happen anytime soon.

“A year from now, there probably will be no euphoria. It’ll be over. They’ll have spent their excess savings. And that’s exactly when interest rates will likely be at their max,” Cramer said.

Source link