[ad_1]

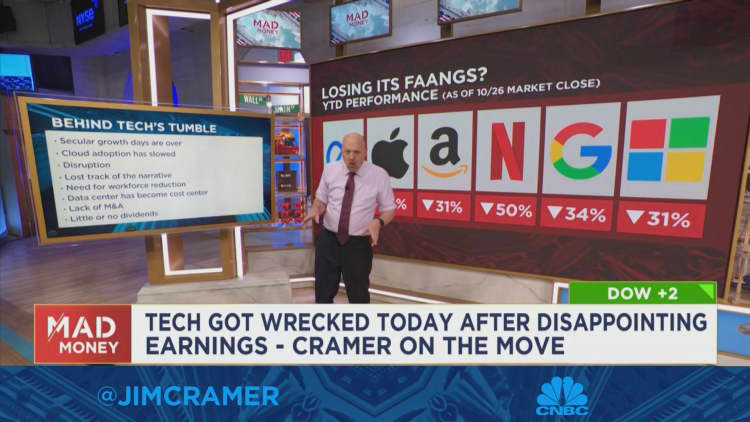

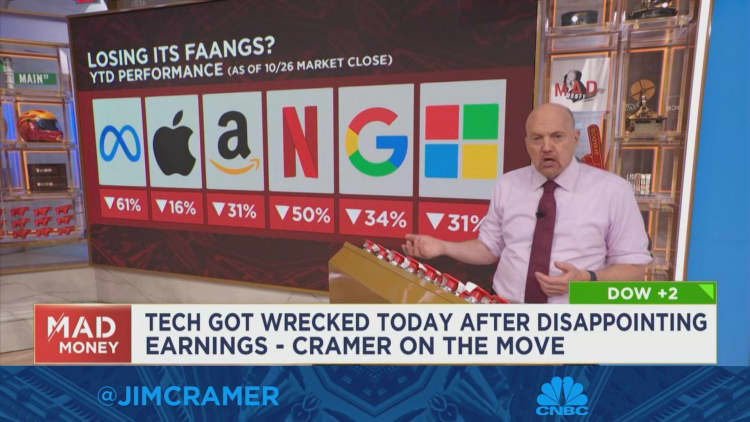

CNBC’s Jim Cramer on Wednesday said that some of the biggest tech companies in the world need to adjust to the changing market.

“It’s time to recognize that FAANG names got too big. Can they turn things around? Sure, but they’ve really got to change the way they operate,” he said, referring to his acronym for Facebook-parent Meta, Amazon, Apple, Netflix and Google-parent Alphabet.

Cramer previously said that financial stocks could overtake tech stocks as the new market leaders in the current high-interest-rate environment. Banks benefit from higher interest rates because they can earn more on loans.

High-growth tech companies such as FAANG names, meanwhile, are hurt by higher interest rates because their stocks trade on the promise of higher returns down the line — a risk that investors typically aren’t willing to take in a turbulent economic environment.

Cramer’s comment comes on the heels of several disappointing earnings results from Big Tech firms. Alphabet missed third-quarter revenue and profit expectations on Tuesday, while Microsoft issued weak quarterly guidance that weighed down its stock.

Meta Platforms reported a wide miss on third-quarter earnings after the close on Wednesday, which sent its stock tumbling over 18% in after-hours trading.

Netflix has fared better than its tech peers, reporting a third-quarter top-and-bottom beat on Oct. 18 along with substantial subscriber growth. The company also provided updates on its plans to crack down on password sharing and introduce a new ad-supported tier.

Cramer said that the streaming giant’s plans for the latter initiative exemplify the type of innovation FAANG companies need to stop their downward trajectory.

“Forget being leaders — Big [Tech] stocks are now followers in a post-Covid era where we’re learning that their earnings were far more inflated by the pandemic than we knew,” he said.

Amazon is slated to report its third-quarter earnings on Thursday.

Disclaimer: Cramer’s Charitable Trust owns shares of Alphabet, Apple, Amazon, Meta and Netflix.

Source link