[ad_1]

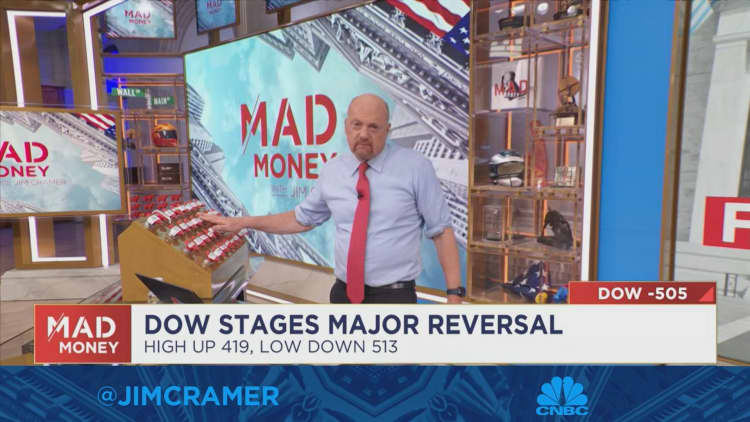

CNBC’s Jim Cramer on Wednesday advised investors to stay away from software stocks.

“Data has become fool’s gold. Data is iron pyrite. When you hear the word data and you see a loss, I don’t care what kind of growth the company has, I don’t care what kind of software it owns, it is bad,” he said.

Stocks fell on Wednesday after the Federal Reserve reiterated its hawkish stance against inflation.

The central bank also raised interest rates by 75 basis points. The decision comes on the heels of numbers that suggest the jobs market is remaining strong, including the hotter-than-expected private payrolls data for October and the JOLTS report on Tuesday.

Cramer said that despite Wall Street’s hopes that the Fed will wind down its aggressive rate hikes sooner rather than later, it’s unlikely to happen until wage inflation and employment both come down.

He also reiterated that investors should target recession-resistant stocks that can withstand the Fed’s tightening cycle.

“The odds [are] that these companies simply won’t be able to outlast [Fed Chair] Jay Powell at the blackjack table. They’re going to go bust,” he said.

Source link